Supports single payment file holding multiple instructions, of different payment types

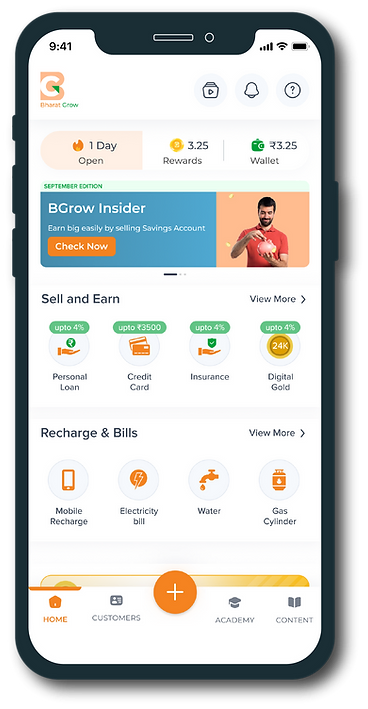

OMNICHANNEL & ONBOARDING

We enable organisations to accelerate the Omni Channel customer onboarding journey by automating and optimising the process by using an automated process

STP and Maker Checker process to go digital with an all-digital process that can be executed without paper and human involvement.

Authentication, Onboarding and Payments are processed offline and reconciled automatically once merchants reconnect to the internet.

Integrations to POS devices for biometric authentication, Bluetooth printing and Voice Notification for door-step delivery.

Easily capture loan applications in the field enables easier repayment at trusted agents.

An innovative feature that enables ATM transactions without using cards.

Extending your services in the remotest areas of the country with no access to branches through agent deployments triggers Financial Inclusion. The solution offers the flexibility and agility necessary for servicing remotely working customers by enabling last-mile connectivity.

We are enabling the retail banking industry with the digital-first approach by providing digital banking-first solutions. Create a unique digital experience for your customer unique needs your bank

We assist companies in achieving three goals via our carefully picked yet highly versatile specific stack: growth, agility, and safety.

Customers can manage all products like savings, loans, cards, payments to have a 360-degree view of their finances

Leverage advanced analytics to gain valuable customer insights to build deeper relationships and deliver relevant services to consumers.

Multimedia and multilingual omnichannel notification. Personalized real-time alerts on unusual behaviour patterns.

Easy-to-use tools for financial insight. Review past spending based on categories and time intervals.

Create custom rules to award loyalty points or cashback on events, usage or frequency of transactions, partial or full redemptions

Enables banks to manage and optimize their corporate client engagement across any device and channel. Get access to a comprehensive dashboard detailing your liquidity position across accounts, upcoming payments, and receipts to make better-informed cash management decisions

Gsmart offers ready-to-configure applications that enable Banks, Credit Unions, and Fintechs

to go to market quickly.

Over the years, we have perfected our technology intending to ease the lives of our customers offering them

high-quality,

easy-to-deploy products. Gsmart prebuilt modules help you with the fastest time to

market without compromising on the security level.